The Walt Disney Company stock closed yesterday at $116.47 a share before reporting their earnings this morning for the second quarter (Q2) of fiscal year 2024 which ended on March 30, 2024. According to the earnings report, revenues for the quarter increased to $22.1 billion from $21.8 billion in the prior-year quarter. Diluted earrings per share (EPS) for the quarter was a loss of $0.01 for the current quarter compared to income of $0.69 in the prior-year quarter, partially offset by higher operating income at Entertainment and Experiences. Excluding certain items, diluted EPS for the quarter increased to $1.21 from $0.93 in the prior-year quarter.

“Our strong performance in Q2, with adjusted EPS(1) up 30% compared to the prior year, demonstrates we are delivering on our strategic priorities and building for the future,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company. “Our results were driven in large part by our Experiences segment as well as our streaming business. Importantly, entertainment streaming was profitable for the quarter, and we remain on track to achieve profitability in our combined streaming businesses in Q4.

“Looking at our company as a whole, it’s clear that the turnaround and growth initiatives we set in motion last year have continued to yield positive results. We have a number of highly anticipated theatrical releases arriving over the next few months; our television shows are resonating with audiences and critics alike; ESPN continues to break ratings records as we further its evolution into the preeminent digital sports platform; and we are turbocharging growth in our Experiences business with a number of near- and long-term strategic investments.”

Statements from Bob Iger in Q2-FY24 Earnings Report

Disney’s second quarter earnings achieved strong double digit percentage growth in adjusted EPS, and met or exceeded our financial guidance for the quarter. As a result of outperformance in the second quarter, TWDC’s new full year adjusted EPS(1) growth target is now 25%. The company remains on track to generate approximately $14 billion of cash provided by operations and over $8 billion of free cash flow this fiscal year. In the second quarter, Disney repurchased $1 billion worth of shares and looks forward to continuing to return capital to shareholders.

The Entertainment Direct-to-Consumer business was profitable in Q2-FY2024. Disney is expecting softer Entertainment DTC results in Q3 to be driven by Disney+ Hotstar, the company continues to expect our combined streaming businesses to be profitable in the fourth quarter, and to be a meaningful future growth driver for the company, with further improvements in profitability in fiscal 2025. Disney+ Core subscribers increased by more than 6 million in the second quarter, and Disney+ Core ARPU increased sequentially by 44 cents.

Sports operating income declined slightly versus the prior year, reflecting the timing impact of College Football Playoff games at ESPN, offset by improved results at Star India.

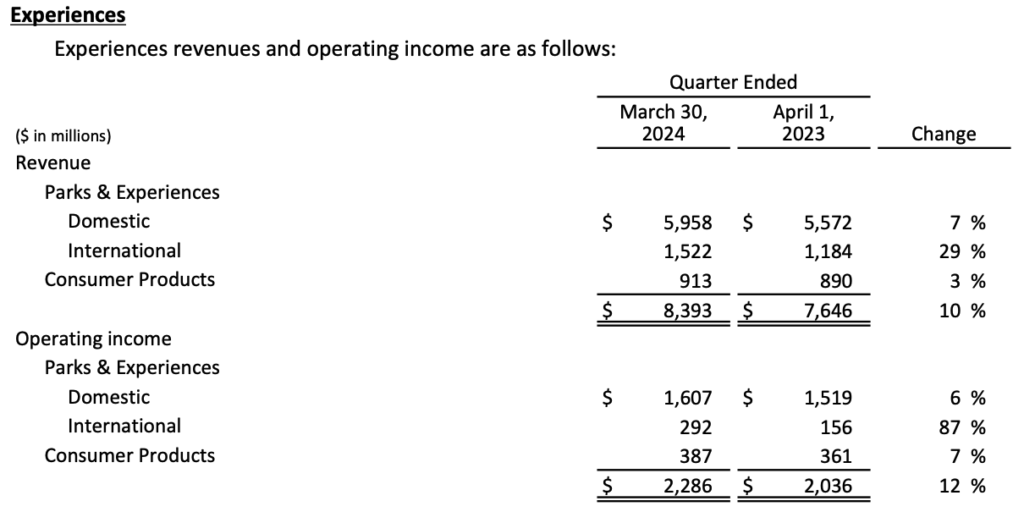

At Experiences, was a growth driver in the second quarter, with revenue growth of 10%, segment operating income growth of 12%, and margin expansion of 60 basis points versus the prior year. Although the third quarter’s segment operating income is expected to come in roughly comparable to the prior year, TWDC continues to expect robust operating income growth at Experiences for the full year.

Capital expenditures for The Walt Disney Company increased to $2.6 billion from $2.4 billion due to higher spend on new attractions and cruise ship fleet expansion at the Experiences segment.

The Experiences segment (which includes Disney Cruise Line) recorded an increase in operating income at the domestic parks and experiences which is attributed to higher results at Walt Disney World Resort and Disney Cruise Line, partially offset by lower results at Disneyland Resort.

At Walt Disney World Resort, higher results in the current quarter compared to the prior-year quarter were due to Increased guest spending attributable to higher average ticket prices, with higher costs due to inflation, partially offset by lower depreciation and cost saving initiatives.

Growth at Disney Cruise Line was due to an increase in average ticket prices, partially offset by higher costs.

The decrease in operating results at Disneyland Resort was due to higher costs driven by inflation, an increase in guest spending attributable to higher average ticket prices and daily hotel room rates. Higher volumes due to attendance growth were partially offset by lower occupied room nights.

Elsewhere in the world, higher international parks and experiences’ operating results were due to an increase in operating results at Hong Kong Disneyland Resort attributable to Guest spending growth due to increases in average ticket prices and food, beverage and merchandise spending. Higher volumes resulting from increases in attendance and occupied room nights. Volume growth benefitted from additional days of operations in the current quarter as well as the opening of World of Frozen in November 2023. Increased costs driven by inflation and new guest offerings.

There were no additional details regarding Disney Cruise Line in the press release. We will update this post if we hear anything during the earnings call and Q&A.

For more information and an overall report click over to the Q2-2024 Earnings Report.