Meyer Werft managing directors Bernard Meyer and Thomas Weigend took to YouTube to provide a state of the MEYER Group message due to the impact of Coronavirus (COVID-19) in the cruise market. During the nearly 10-minute video they talk about the consequences for their customers and their order book. MEYER Group does not anticipate any new orders until 2023/24, and now the are working to stretching their current slate of ship builds of which include three Disney Cruise Line ships beginning with the Disney Wish. Due to a significantly lower workload, they foresee the potential they may need to consider reducing our workforce.

The video is presented in German with English subtitles. A transcript of the English subtitles are presented below the video.

English transcript from the video captions.

What impact is the Corona cruising having on the cruise market?

We are currently experiencing the greatest crisis in the history of modern cruising.

Until now, the most drastic even has always been September 11, 2001, followed by the banking and economic crisis in 2008/2009.

In both cases, however, cruises were still taking place at that time.

The Corona crisis is by far more drastic, as for the first time in the 50-year history of cruise shipping almost all cruise ship worldwide are laid up.

In this crisis, our customers are also struggling to survive.

Until last week, most cruise lines had cancelled their voyages by the end of May at the latest and expected to be able to take passengers on board again from June onwards.

The US federal authority CDC (Centers for Disease Control and Prevention) has already extended its no sale order in waters over which the United States has jurisdiction by a further 100 days until 23 July.

It is therefore foreseeable that the extent of the Corona crisis is far more serious for the cruise market than previously assumed.

How is the corona crisis affecting new cruise ship orders?

Market observers expect a maximum of 50-75% resumption of the global cruise ship fleet by the end of 2020.

This means the cruise lines will experience massive losses in 2020.

If things develop well, the shipping companies could perhaps break even in 2021 and possibly make profits again from 2022 onwards to pay off debts they made during the crisis.

This means that no new orders for cruise ships are expected until 2023 or 2024.

Should one or more shipping companies slide into insolvency, these ships will of course suddenly be available on the market as cheap second-hand ships.

If this were the case, new orders would probably come to a standstill for much longer.

What does this mean for cruise shipyards?

Thomas Weigend – Managing Director

It is quite clear that all cruise shipyards will have massive overcapacity.

In the short term, the shipping companies cannot use any new buildings at all.

In the medium term, they will try to postpone delivery dates and will not execute options.

In the long term and thus for years to come, shipping companies will not order any new cruise ships.

70% of the shipyard capacity for cruise ships worldwide is in state ownership.

As a private shipyard, it is a huge challenge for us to hold our own against state competition.

How affected is the MEYER Group’s order Book?

Our current scenarios assume that in the best case scenario we will have to adjust capacity at the Papenburg site from two large and one small ship per year to one large and one small ship.

Since we cannot expect any newbuilding orders until 2023/24, we will try to stretch the current order book at all locations.

We are currently holding talks with our customers to this end.

Such an adjustment would mean that we would have to cut our work performance by about 40%.

This will have consequences for the entire MEYER Group.

What measures have we initiated so far?

We have already decided to reduce investments considerably and to stop new hires and contract awards.

If we stretch our order book, we will not be working to full capacity in many divisions in the coming months and possibly even years.

In order to counter this declining workload in the short term, we are currently negotiating with the Works Council on the issue fo short-tine work.

We have also decided that overtime and weekend work will be dispensed with and that old vacation must be reduced.

We are also reducing the number of employees on subcontracted employment and the number of employees on contracts for work and services.

These are short-term measures that we can implement quickly to reduce work performance.

We are thus preparing ourselves on a small scale for a possible stretching of the order book.

This is because in many areas there will be considerable less work to do.

Why do we have a problem now when our order book will last until 2023?

I have been a the shipyard for 47 years this year and I have never experienced such a crisis in these 47 years.

I started n 1973 and the oil crisis occurred.

We have had great problems keeping the shipyard we have just built busy.

The second big crisis was September 11, 2001, when suddenly nobody could or wanted to go on a cruise.

And the their big crisis was the 2008/2009 financial crisis.

But this crisis is quite different.

Never before has the entire cruise fleet of the world with more than 400 ships stood still.

And that is something I have never experienced before.

Yes, we have contracts until 2023 and in Turku even until 2024, but these contracts have been made on completely different terms.

We are in a great crisis.

One of our customers said he doesn’t really need your ships anymore.

He’ll be happy to use the existing fleet again.

So we have to sit down with our customers and try to find a solution that is bearable for both sides.

And that’s why we’re thinking about stretching our construction program, so we don’t get any cancellations of orders.

This is a tough task.

Are the measures already taken sufficient to overcome the Corona crisis?

There simply won’t be as many cruise ships built and needed in the near future.

Unfortunately, we have to go back in all companies and in all areas and consider how we can restructure our work.

That means less work in the project area, less work in the design offices and that means less work in production and the subsidiary companies.

Everyone is affected. We have to think about short-term work in all areas, but also about job cuts. We simply do not need so many cruise ships any more.

What does this mean for the MEYER Group I concrete terms?

I started in 1973 at the shipyard and then came the oil crisis, the tanker crisis and then the shipyard crisis. It took us 20 years to be back where we were in 1973.

That is why I am unfortunately convinced that the cruise market will not recover so quickly. Only in 2030 will we have the situation we had last year.

This means that we will have to adapt the shipyard completely to the new situation.

But I am also convinced that we have the flexibility to think about our structures, how everyone will see their jobs in the future and how we will restructure our costs.

But above all, we need to have many new ideas. This is the chance of a private ship yard compared to the state-owned ship yards.

Only together, with joint forces, will we succeed. And I am sure that we will make it! Thank you.

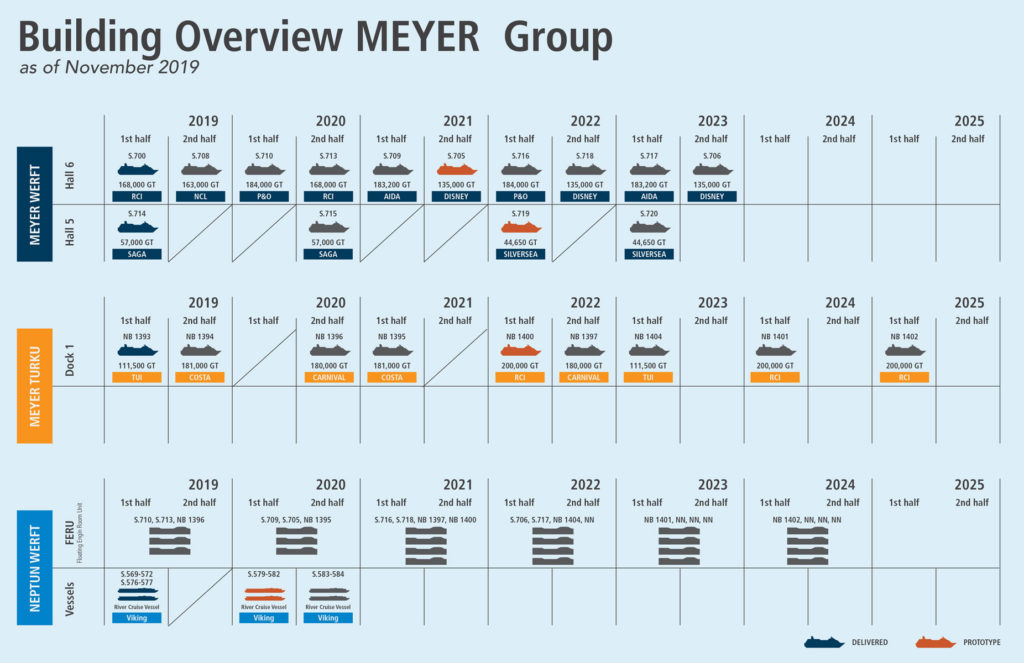

Below is a look at MEYER Group’s orderbook as of November 2019.

While there was no direct mention of Disney Cruise Line’s orders, AIDA, P&O, and Disney are the three lines on MEYER Group’s orderbook for Papenburg. It is not much of a stretch that Disney is absolutely part of the discussion when the Weigend referenced the Papenburg shipyard adjusting capacity “from two large and one small ship per year to one large and one small ship.” Worst case could stem from Meyer’s comment, “one of our customers said he doesn’t really need your ships anymore” becasuse “he’ll be happy to use the existing fleet again.“

Looking deeper into the above build schedule, you will notice Neptun Werft’s Floating Engine Room Unit (FERU) lists the construction of the engine blocks for the 3 Disney LNG-powered cruise ship hull numbers S.705 in 2020, and S.718 in 2021.

Only time will tell what will happen with Disney Cruise Line’s three orders at Meyer Werft, but it sounds like a best case scenario keeps the current orders on track with a shift in delivery dates.

My guess is that the “WISH” will not sail with passengers until 2023 and ship # 6 in 2024 and ship # 7 in 2025. It also keep the possibility of ships #6 and #7 being cancelled. I read recently that between the cruise line and theme park operations that Disney is losing revenue of up to $30,000,000 per day

Very dark picture indeed and very hard times for a company full of very skilled people.