This week, Disney Cruise Line’s annual report for fiscal year 2023 was made public. Within the 61-page filing, the document contains a strategic report compiled by the directors which discusses the return to profitability following the significant impact of the coronavirus pandemic on the cruise line in previous fiscal years. This was driven by higher occupancy rates and the addition of the Disney Wish in the prior fiscal year generating income for the company during the full FY23. The cruise line anticipates its financial performance will continue to maintain profitability in 2024 as the industry continues to fully recover from the impact of COVID-19 and the business benefits from expanded capacity with the soon to be delivered Disney Treasure.

Before we get into the details, it is worth mentioning The Walt Disney Company released their FY23 earnings report back in November 2023. Disney Cruise Line is part of the Experiences division. More often than not, there is little mention of the cruise line during the quarterly earnings webcast and report. Due to the company’s size, Disney Cruise Line’s financials are bundled in the Experiences summary item leaving little insight into the cruise line’s business. Since, Disney Cruise Line is actually Magical Cruise Company, Limited registered in London, the company is required to submit an annual report in the United Kingdom.

Remember, the financial information in the annual report is for FY23 (year ending September 30, 2023), we will get to this eventually. The interesting information, prepared on behalf of the Board dated June 27, 2024 from the strategic report is transcribed below.

Magical Cruise Company, Limited

Strategic report for the period from 2 October 2022 to 30 September 2023

The Directors present their Strategic report of Magical Cruise Company, Limited (the ‘Company’) (trade name “Disney Cruise Line”) for the period from 2 October 2022 to 30 September 2023 (prior financial period from 3 October 2021 to 1 October 2022).

Principal activities and business review

The principal activity of the Company is the operation of Disney themed luxury cruise vessels. It is considered that the Company’s activities will remain unchanged for the foreseeable future.

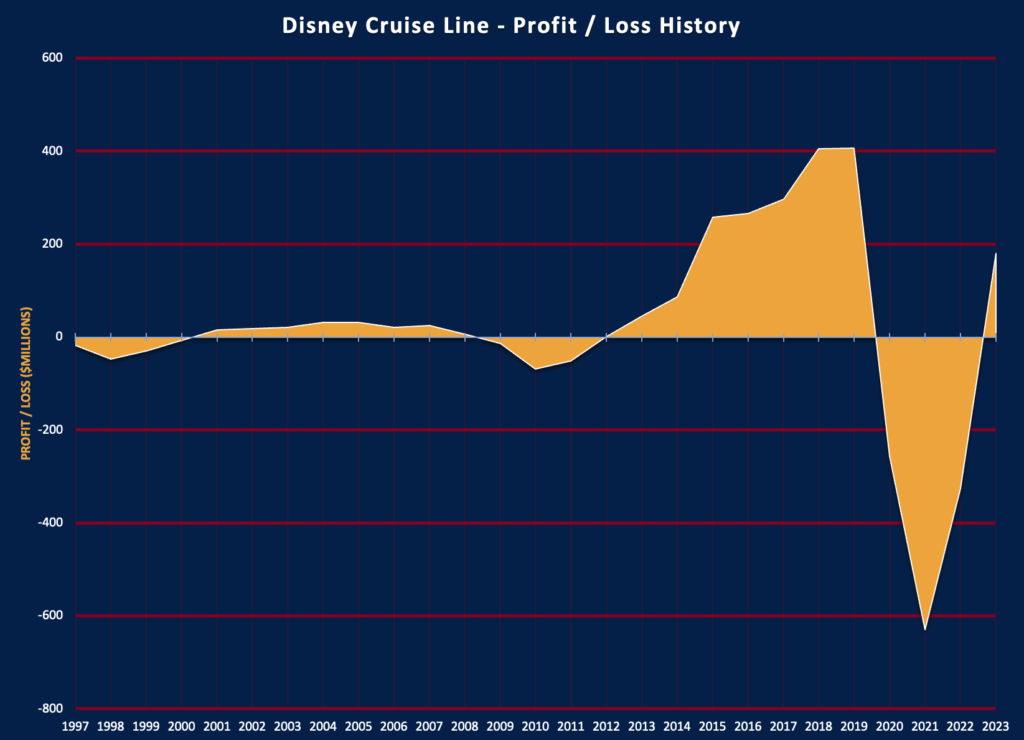

The Company’s profit for the financial period is $180,531,000 (2022: loss of $325,799,000).

Revenue and operating income improved period over period due to higher occupancy rates and the addition of a new ship to the fleet, the Disney Wish, which was delivered in June 2022 and sailed through the full fiscal year 2023.

On 17 March 2016, The Walt Disney Company (TWDC), through-subsidiary, DCL Maritime LLC, entered into a contract wi the German Shipyard Meyer Werft GmbH & CO. KG (Meyer Werft) to build and deliver the Disney Wish (~144,400-ton ship delivered in 2022) as well as two additional ships (approximately 140,000 tons) the sixth and seventh ships in the fleet. During September 2022, Disney announced the name of the 6th ship in their fleet as ‘Disney Treasure’, and in March 2024 Disney announced the name of the 7th ship in their fleet as ‘Disney Destiny’.

The Company originally contracted to purchase and receive the Disney Treasure and the Disney Destiny in calendar years 2022 and 2023, respectively. The impact of COVID-19 and the war in Ukraine has resulted in a delay in the delivery of these cruise ships. The Company now expects the Disney Treasure and the Disney Destiny to be delivered ni 2024 and 2025, respectively.

As part of Disney Wish purchase, the Company received a $500,000,000 promissory note from Disney Enterprises, Inc with a maturity date of 15 June 2023 (1 year from the date of the agreement). On June 5, 2023 the Company paid off the promissory note and replaced it with a $500,000,000 revolving credit facility agreement with Disney Enterprises, Inc., concurrently borrowing $500,000,000, the maximum revolving credit facility amount. On 28 September 2023, the $500,000,000 revolving credit facility with Disney Enterprises, Inc. was paid ni full, and no new borrowings have occurred. To partially fund repayment, the Company issued 311,194,824 ordinary shares of £1.00 in exchange for cash of $380,000,000 to Wedco EMEA Ventures Limited on 28 September 2023. The remaining amount (USD equivalent of $120,000,000) was paid using Company operating cash flows.

In November 2022, the Company purchased a partially completed ship, to expand its fleet (an eighth ship) and travel to new destinations – the ship will be approximately 200,000 tons. Disney Cruise Line will incur the cost to complete construction. In September 2023, Disney announced the name of this ship as the ‘Disney Adventure’. The Disney Adventure is expected to be delivered in 2025.

On 31 August 2023, the Company was involved in a reorganization that resulted in the transfer at book value of $2,939,368,000 of its ordinary shares (GBP 1 each) to Wedco EMEA Ventures Limited (“WEVL”). As a result of the reorganization, the Company is now a wholly owned subsidiary of Wedco EMEA Ventures Limited.

Future developments

The Company anticipates its financial performance will continue to maintain profitability in 2024 as the industry continues to fully recover from the impact of COVID-19 and the business benefits from expanded capacity with the soon to be delivered Disney Treasure. in fiscal 2024, the Company has seen occupancy and booking levels continue to perform well, with occupancy exceeding the comparable actual financial period 2023 quarterly levels on a period over period basis.

We continue to remain optimistic about the future as the Company continues to advance the development of its next two new cruise ships and the recently acquired partially completed ship ‘Disney Adventure’. All are in active construction and expected to be delivered in 2024 and 2025 time frames. In addition, DCL Island Development Limited (the Company’s 100% owned subsidiary company) is advancing the development of its second private island, Lighthouse Point in Eleuthera, The Bahamas, which opened in June 2024.

Going concern

The Directors have undertaken an assessment by reviewing a cash flow forecast extending to a period no less than 12 months from the date of the financial statements, including consideration of severe yet plausible downsides, reflecting that the Company was in a net current liability position as at 30 September 2023. Whilst they expect to be able to meet the day to day cashflow needs of the Company, they have received assurances of continued financial support from a fellow Group undertaking, in the form of a letter of support, to allow the Company to meet its liabilities as they fall due without significant curtailment of operations for a period of at least 12 months from the date of these financial statements being signed.

On the basic of their assessment of the Company’s financial position, its resources and support from fellow group company, the Directors believe that the Company is well placed to manage its business risks. Therefore, the Directors have reasonable expectation that the Company has adequate resources to continue in operational existence for the foreseeable future. Thus they continue to adopt the going concern basis of accounting in preparing the annual financial statements.

Principal risks and uncertainties

From the perspective of the Company, its principal risks and uncertainties and future outlook are integrated with those of The Walt Disney Company (‘Group’) and are not managed separately. Accordingly, the risks and uncertainties of the Group, which include those of the Company, are discussed in the Group’s annual report which does not form part of this report. However, the Directors view the following as being the principal risks facing the Company:

From the perspective of the Company, its principal risks and uncertainties and future outlook are integrated with those of The Walt Disney Company (‘Group’) and are not managed separately. Accordingly, the risks and uncertainties of the Group, which include those of the Company, are discussed in the Group’s annual report which does not form part of this report. However, the Directors view the following as being the principal risks facing the Company:

1) Our sales may be adversely affected by changes in economic factors, political uncertainty and changes in consumer spending patterns

Many economic and other factors outside our control, including consumer confidence, consumer spending levels, political uncertainty, employment levels, consumer debt levels, inflation and deflation, as wel as the availability of consumer credit, affect consumer spending habits. A significant deterioration in the global financial markets and economic environment, recessions or an uncertain economic outlook adversely affects consumer spending habits and results in lower levels of economic activity. In addition, an increase in price levels generally, or in price levels in a particular sector such as the energy sector, could result in a shift in consumer demand away from the entertainment and consumer products we offer, which could also adversely affect our revenues and, at the same time, increase our costs. Any of these events and factors could cause consumers to curtail spending and could have a negative impact on our financial performance and position ni future financial periods. The impact of pandemics on consumer confidence and ultimately occupancy levels could also affect our financial performance.

2) Our industry is highly competitive and competitive conditions may adversely affect our revenues and overall profitability

The cruise industry is highly competitive and our results of operations are sensitive to, and may be adversely affected by, competitive pricing and other factors.

3) A variety of uncontrollable events may reduce demand for our products and services, impair our ability to provide our products and services or increase the cost of providing our products and services

Demand for and consumption of our products and services, is highly dependent on the general environment for travel and tourism. The environment for travel and tourism, as well as demand for and consumption of other entertainment products, can be significantly adversely affected in the U.S., globally or in specific regions as a result of a variety of factors beyond our control, including: adverse weather conditions arising from short-term weather patters or long-term change, catastrophic events or natural disasters (such as excessive heat or rain, hurricanes, typhoons, floods, tsunamis and earthquakes); health concerns (including as it has been by COVID-19); international, political or military developments; and terrorist attacks. These events and others, such as fluctuations in travel and energy costs and computer virus attacks, intrusions or other widespread computing or telecommunications failures, may also damage our ability to provide our products and services or to obtain insurance coverage with respect to some of these events. An incident that affected our property directly would have a direct impact on our ability to provide goods and services and could have an extended effect of discouraging consumers from attending our facilities. Moreover, the costs of protecting against such incidents, including the costs of protecting against the spread of COVID-19, reduces the profitability of our operations.

4) Changes in regulations applicable to our businesses may impair the profitability of our businesses.

These regulations may include, but are not limited to:

- Federal, State and foreign privacy and data protection laws and regulations.

- Regulation of the safety and supply chain of consumer products and Cruise Line operations.

- Domestic and international wage laws, tax laws or currency controls.

- Environmental protection regulations.

5) Fuel prices

Fuel is a significant portion of overall costs. The Company is exposed to commodity fluctuations due to commodity price changes. The Company employs several levers to reduce exposure to fuel price fluctuations, such as price hedging strategies, fuel vendor diversification, and securing future supply through offtake agreements. With respect to the risks the Directors regularly review such matters to mitigate their respective impact on the Company.

6) Protection of electronically stored data and other cybersecurity is costly, and if our data or systems are materially compromised ni spite of this protection, we may incur additional costs, lost opportunities, damage ot our reputation, disruption of service or theft of our assets

We maintain information necessary to conduct our business, including confidential and proprietary information as well as personal nfrmaetion regarding our customers and employees, in digital form. We also use computer systems to deliver our products and services and operate our business. Data maintained in digital form is subject to the risk of unauthorized access, modification, exfiltration, destruction or denial of access and our computer systems are subject to cyberattacks that may result in disruptions in service. If our information or cyber security systems or data are compromised in a material way, our ability to conduct our business may be impaired, we may lose profitable opportunities or the value of those opportunities may be diminished. If personal information of our customers or employees is misappropriated, our reputation with our customers and employees may be damaged resulting ni los of business or morale, and we may incur costs ot remediate possible harm to our customers and employees or damages arising from litigation and/or to pay fines or take other action with respect ot judicial or regulatory actions arising out of the incident.

7) Damage to our reputation or brands may negatively impact our Company

Our reputation and globally recognizable brands are integral to the success of our business. Because our brands engage consumers across our businesses, damage to our reputation or brands in one business may have an impact on our other brands.

Key performance indicators (“KPIs”)

The Company’s KPl’s are as follows:

| Measure | Description | Period ended 30 September 2023 $’000 | Period ended 1 October 2022 $’000 |

|---|---|---|---|

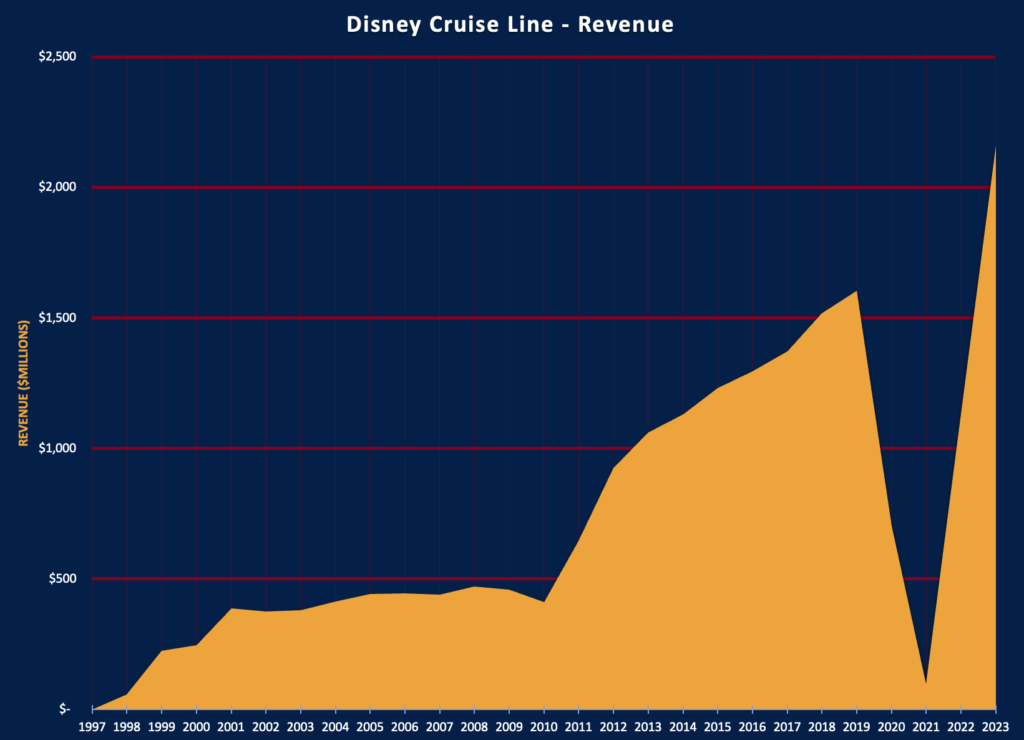

| Turnover | Total revenue for the financial period | 2,161,547 | 1,134,017 |

| Profit/(loss) | Overal profit/(loss) for the financial period | 180,531 | (325,799) |

We have seen an increase in occupancy for the full year to 95% as of September 2023 from 63% as of September 2022. We have seen a further increase in occupancy levels in fiscal year 2024 to 97% as of December 2023. The Company anticipates its financial performance will maintain profitability in 2024 due to favorable cruise industry demand coupled with the expanded capacity of the fleet from the soon-to-be-completed Disney Treasure (2024) as well as two new future cruise ships in 2025.

Section 172(1) statement

As a subsidiary within the Group of companies of which The Walt Disney Company is the ultimate parent company (the “Group”), the Company is subject to organisational and management systems which enable the Board of Directors (“the Board”) to oversee governance of the activities of the Company. As is normal for large companies, the Board delegates authority for day-to-day management of the Company to the managers responsible for management of the Company. The Board ensures that when applying Group policies and delegating responsibility for operational matters to the managers, ti does so with due regard to its fiduciary duties and responsibilities.

The Directors of the Company are aware of their duty under section 172 of the Companies Act 2006 to act in a way that they consider, in good faith, would be most likely ot promote the success of the Company for the benefit of its members as a whole. nI doing so they have considered (amongst other matters) factors (a) to (f) listed below:

- the likely consequences of any decision in the long term;

- the interests of the Company’s employees (also known as “Cast Members”);

- the ned to foster the Company’s business relationships with suppliers, customers (known as “Guests”) and others; d) the impact of the Company’s operations on the community and the environment;

- the desirability of the Company maintaining a reputation for high standards of business conduct; and

- the need to act fairly between members of the Company.

In performing their duties under section 172, the Directors of the Company have had regard to the matters set out in section 172(1) as follows:

a) The likely consequences of any decision in the long term

We are aware that our decisions and strategies can have long-term effects on our business and its stakeholders. Therefore we aim to make wel informed, fair and balanced decisions. Our key stakeholders, include Crew Members, Cast Members, Guests, home ports and ports of call, regulators and suppliers who are at the forefront of our minds when making decisions. We set out below some of the decisions the Board has taken during the course of the period with a view to creating long term success for the Company and its stakeholders as a whole.

During the first quarter of fiscal 2023, Disney Cruise Line continued ot adjust its health and safety protocols as the COVID-19 public health environment improved, with vaccination requirements ending in early-September 2022 and testing requirements ending in mid-November 2022. By the second quarter of fiscal 2023, guest-related health and safety protocols returned to pre-pandemic operations, though Crew Members are still required to be vaccinated against COVID-19 and are tested for COVID-19 before boarding. Health and safety is a top priority for Disney Cruise Line as it continues to operate in a responsible manner and effectively manage any cases of COVID-19 aboard its ships.

Disney announced in November 2022 the acquisition of a partially completed ship. Disney is working with the Meyer Wismar Sarl & Co. KG shipbuilding company in Wismar, Germany to complete the cruise ship previously known as the Global Dream, renamed as ‘Disney Adventure’ in September 2023. In March 2023, Disney Cruise Line and Singapore Tourism Board announced an agreement to homeport the new ship exclusively in Singapore for at least five years beginning in 2025.

In September 2023, Disney revealed new details about its second Wish class ship, the Disney Treasure, which will embark on its maiden voyage, in December 2024. The third Wish class ship, the Disney Destiny, is expected to be delivered in 2025. All three Wish-class ships are (or will be) powered by liquified natural gas (LNG). At approximately 144,000 gross tons and 1,250 Guest staterooms, they are slightly larger than the Disney Dream and Disney Fantasy.

Disney Cruise Line celebrated its 25th anniversary with special “Silver Anniversary at Sea” entertainment, merchandise and experiences during select sailings from May through September of 2023. As part of its anniversary, Disney Cruise Line also unveiled a brand-new membership tier for its Castaway Club loyalty program. Members will now earn the distinction of Pearl status after 25 Disney Cruise Line vacations and will unlock new at-home and onboard benefits.

Disney Cruise Line introduced the MagicBand+ technology used at Walt Disney World Resort and Disneyland Resort to its fleet in fiscal 2023. Disney Cruise Line is calling the wearable technology DisneyBand+. Uses of the new technology include unlocking Guests’ stateroom doors, charging onboard purchases, linking photos from DCL’s onboard photographers, and discovering enchanting surprises throughout the cruise. DisneyBand+ is an optional add-on and is not included in the cruise fare.

Disney Cruise Line continued progress on its new terminal at Port Everglades in Fort Lauderdale, Florida, USA. The 15-year partnership commits to a minimum of 10.6 million passenger movements, and three 5-year extension options that could add another 11.25 million passenger movements. The agreement provides for one ship to be homeported in Port Everglades year-round beginning November 2023, joined by a second, seasonal ship in March 2025.

Disney shared new details in fiscal 2023 about its second island destination in Eleuthera, The Bahamas, which will debut to Guests in June 2024. The destination wil be called Disney Lookout Cay at Lighthouse Point and will invite Guests to escape to a vibrant tropical retreat offering a unique window into the rich culture, traditions and stories of The Bahamas. Disney is working closely with Bahamian artists and advisors to create a destination that represents the natural beauty and rich culture of the Bahamas. The destination will create sustainable economic opportunities for Bahamians, protect and sustain the natural beauty of the site, celebrate culture, and help strengthen the community in Eleuthera. Disney has committed to develop less than 20 percent

of the property, supply 90 percent of the site’s power from solar energy, employ sustainable building practices, and donate more than 190 acres of privately owned land to the government.

b) The interests of the Company’s employees

Since its launch in 1998, Disney Cruise Line is a well-established name in the cruise industry, providing a setting where families can reconnect, adults can recharge and children can experience al Disney has to offer. We strive to provide exceptional service that reflects our iconic brand, enabled by the passion and hard work of our Cast and Crew. We understand the importance of our employees to our long-term success and are committed to providing a safe working environment, a diverse and inclusive culture and appropriate training and development.

Disney Cruise Line also complies with, and in some cases exceeds, the requirements set forth in the International Labour Organization’s (ILO’s) Maritime Labour Convention (MLC) which governs almost all aspects of working aboard a ship. Crew Members are organized through a collective bargaining unit (union) through the Federazione Italiana Transporti (FIT). The current union agreement went into effect on 1 January, 2023 and is binding for four years. It stipulates compensation, benefits, working hours, and contract lengths for the range of work positions on-board.

Disney Cruise Line Cast and Crew Members receive a wide range of employment benefits. While on contract in service of the ship, Crew Members receive medical care by the on-board medical team. Officers are offered full health benefits year-round when signed to a contract. Crew Members have access to mental health resources through an Employer Assistance Program offered in multiple languages, as wel as access to online resources and wellness content offered on-demand via Crew stateroom TVs.

Disney has an ongoing commitment to diversity, equity and inclusion (DE&I) through a company-wide initiative composed of six pillars focused on People, Culture, Content, Community, Transparency, and Accountability.

c) The need to foster the Company’s business relationships with suppliers, customers and others

We pride ourselves on delivering exceptional service and world-class family holidays. We have strong relationships with our suppliers and work closely with them to provide our Guests with high quality experiences and products.

Guests

Creating unforgettable holiday experiences for our Guests is the primary motivation of our dedicated Disney Cruise Line Cast and Crew Members. Disney Cruise Line is considered a leader in the cruise industry by travel professionals, hospitality industry Groups, and most importantly – by our Guests. Families sailing with Disney Cruise Line expect à unique holiday experience that only Disney can deliver. At the heart of all we do si the Guest experience and satisfaction with the Disney Cruise Line product. Multiple touch points provide us with the opportunity to hear directly from our Guests about what we’re doing right and areas for improvement. Our Call Centre and Guest Communications team resolves issues brought to our attention in a timely manner, corresponding directly with any Guest who reaches out to us for assistance before, during and after their cruise. Our team si specifically trained to assist our Guests with their holiday needs and consistently receives some of the highest Guest Service satisfaction ratings within our Company.

Suppliers

Disney Cruise Line has high standards for suppliers and has a thorough process for sourcing products and services of the best quality and value. Suppliers are held to TWDC’s International Labour Standards and Code of Conduct for Suppliers. Our supply chains follow Disney policies and comply with UK government regulations. Food and beverage suppliers must follow a uniform set of TWDC guidelines that meet both Company and local standards, including conducting periodic sanitation and safety audits and maintaining liability insurance.

Disney Cruise Line also partners with travel agents for a significant source of cruise bookings. Travel agents must be a registered Member supplier in good standing with the Cruise Line Industry Association or the International Air Transport Association (IATA), and supply proof of all qualifying tax and other documentation required to do business as a travel agent/agency in its domestic and international markets. Travel agents and agencies must operate ethically, representing the Disney Cruise Line brand in good faith and providing accurate marketing and information about Disney Cruise Line’s products.

Disney Cruise Line is committed to conducting business and providing products and services in an ethical manner. We also believe that including diverse suppliers in our sourcing process provides us the greatest opportunity. to develop the most innovative, highest quality, and most cost-effective business solutions. We know this strengthens our Company as well as supporting our communities.

Port Communities

Disney Cruise Line is very mindful of our impact on local communities. We engage in an ongoing basis with al our relevant has made significant economic contributions to The Bahamas while demonstrating a strong commitment to the environment and the community.

Disney Cruise Line takes careful steps to ensure it respects the communities, environment and culture of each of its destinations through collaboration with stakeholders and relevant partners in ports of cal. This includes understanding how to introduce our brand most appropriately to those communities, as well as introduce the unique character and culture of each destination to Disney Cruise Line Guests. We source products in our ports of call when it meets our quality standards, and we work with a variety of tour providers in each destination to diversify our products.

d) The impact of the Company’s operations on the community and the environment

Community

Since The Walt Disney Company’s founding 100 years ago, we remain deeply committed to operating with integrity, taking care of our people and doing good in our world as we grow our businesses. Our corporate social responsibility (CSR) efforts address the expectations of our people, consumers, communities, and investors, and help us to attract, retain, and develop talented and diverse creators and Cast Members, al of whom contribute to our business success. We take a strategic approach to setting our CSR priorities, addressing issues that are important to our businesses and to the communities where we operate. We regularly monitor issues and evolve our efforts to ensure we remain focused on the economic, environmental, and societal matters that impact those we serve.

Disney strives to inspire a world of belonging by embracing broad representation and respect for every individual in our workplace, storytelling, and communities; a world in balance by taking action to create a cleaner, safer, and healthier world; and a world of hope by supporting our communities, especially children. We are also investing in our people and operating responsibly.

Disney Cruise Line strives to make a positive impact in the many places around the world where it visits and operates. Disney Cruise Line Cast and Crew Members support many charitable organizations that provide youth education programs and that enrich the environment. Crew Members lead reading education programs in schools, give to local youth organizations and bring Disney characters to entertain children in port communities around the globe. Disney VoluntEARS also donate their time to plant micro-gardens at underserved schools, lead career exploration conversations for students interested in maritime careers, raise funds for worldwide disaster relief efforts, and host regular shore clean-ups to remove litter and debris from fragile coastlines. Each period, Cast and Crew Members donate thousands of hours of their personal time to benefit worthwhile causes in port communities around the world.

For more than 25 years, Disney Cruise Line has made significant contributions to support communities in The Bahamas. Recent key initiatives focus on supporting entrepreneurs and small businesses, workforce development starting at a young age, conservation and timely community needs.

During the holiday season, Cast and Crew Members travelled to the Ranfurly Homes for Children in Nassau, The Bahamas, to visit with the young residents and bring holiday cheer. The Ranfurly Homes for Children is a local non-profit foster care organization that provides comprehensive childcare services for displaced children in the Bahamas. Disney Cruise Line crew members spent the day with the children creating holiday ornaments, delivering gifts and surprising the kids with a special visit from Captain Mickey Mouse. Disney Cruise Line returned to the Ranfurly Homes for Children in collaboration with the Agricultural Development Organization and other community partners to launch a new Community Farming project supporting youth gardening programs across The Bahamas.

In Papenburg, Germany, where Disney Cruise Line’s Wish class ships are being built, Disney Cast and Crew volunteered at the local Christmas Market, distributing donated Christmas ornaments and children’s books. Christmas cookies were also sold with al proceeds benefiting Make-A-Wish International as part of The Walt Disney Company’s “From Our Family To Yours” campaign that aims to inspire a better world through the power of storytelling.

Disney Cruise Line collaborated in March 2023 with Junior Achievement Bahamas and The Bahamas Ministry of Youth, Sports and Culture to support students from 10 schools in Eleuthera to celebrate the rich traditions of Junkanoo – a longstanding Bahamian tradition, passed down from generation to generation that celebrates Bahamian culture. In addition to providing funding and donating materials to support the Eleuthera Junior Junkanoo competition, Disney Cruise Line hosted a series of virtual, interactive workshops for students to pair up with Disney professionals, who specialize in costuming, cosmetology and entertainment, to exchange ideas and learn from each other about Junkanoo and costume design. Disney Cruise Line si also a founding sponsor of the Eleuthera Business Hub, in partnership with the Eleuthera Chamber of Commerce and the Small Business Development Centre and is providing financial support to small and medium-sized businesses.

Disney is committed to supporting education in The Bahamas and continues to work with the Ministry of Education to inspire and educate the next generation of professionals. in 2019, Disney Cruise Line introduced a scholarship program in partnership with the LJM Maritime Academy for cadets aspiring to become ship captains and shipboard leaders. in addition, Disney Cruise Line sponsors the academy’s Summer Camp program and welcomes students for day tours aboard its ships to experience first-hand what it’s like to work aboard a ship.

As part of its commitment to inspire the next generation while creating lasting, positive impacts in The Bahamas, Disney Cruise Line donated school supplies to nearly 1,000 students across Abaco and in Eleuthera at the start of the school year in fiscal 2023. Supporting students who live near Disney Cruise Line’s homeport in Port Canaveral, Florida, Cast and Crew volunteered their time to sort donated school supplies and fil backpacks ahead of the school year. Crew Members also volunteered with the nearby Children’s Hunger Project, which provides weekend and summer meals to local children in Brevard County, Florida to fight childhood hunger and malnutrition. Similar initiatives to address food insecurity and support students’ education took place in Disney Cruise Line’s key port communities of Juneau and Skagway, Alaska, as well as in San Diego, California.

As part of The Walt Disney Company’s global commitment of $100 million to help reimagine the patient experience in children’s hospitals, Disney Cruise Line donated five Mobile Movie Theatres to children’s hospitals in port communities in Florida, Texas, California and Louisiana during fiscal 2023. The donations were made with support from the Starlight Children’s Foundation.

Environmental

The Walt Disney Company is committed to taking meaningful and measurable action to support a healthier planet for future generations as we operate and grow our business. Our commitment to environmental stewardship goes back to our founding nearly 100 years ago. Walt Disney himself said that “conservation isn’t just the business of a few people. It’s a matter that concerns all of us.”

The environmental commitments detailed below represent some of the ways Disney Cruise Line is focused on helping to build on that legacy. Our environmental policies are based on a set of guiding principles intended to drive both our long-term environmental strategy and the everyday decision-making of our leadership and Cast and Crew Members around the world.

The Walt Disney Company has made a 2030 net zero pledge and aims to establish and sustain a positive environmental legacy for Disney and for future generations. The Company has ambitious environmental goals for 2030 focused on key areas of our business where we believe we can have a significant, lasting impact and make a positive difference in protecting our planet. Goals include:

- Have a positive impact on the communities where we operate our businesses;

- Create unique content and experiences that inspire connection with our planet and al who call it home;

- Reduce the environmental impacts of our operations, products, services, suppliers, licensees and value chains;

- Promote a culture of consideration, appreciation and respect for the environment among our leaders, Cast Members and Guests;

- Work with industry partners, non-governmental organisations, academia and others to create a cleaner, safer, healthier world for future generations.

At Disney Cruise Line, we are dedicated to minimizing our impact on the environment through efforts focused on utilizing new technologies, increasing fuel efficiency, minimizing waste and promoting conservation worldwide. We strive to instill positive environmental stewardship in our Cast and Crew Members and seek to inspire others through programs that engage our Guests and the communities in our ports of cal. Disney Cruise Line is consistently recognized as an industry leader and regularly wins awards such as the Blue Circle Award from Port of Vancouver for voluntary efforts to conserve energy and reduce emissions.

As of 1 January 2020, the International Maritime Organization instituted a regulation that requires all ships to use 0.5% sulfur fuel compared to 3.5% previously. Disney Cruise Line has taken this a step further by using 0.1% low sulfur fuel fleetwide at all times. As previously mentioned, our Wish class of cruise ships are powered by liquefied natural gas, or LNG. In addition to LNG used onboard the Wish class, in fiscal 2023 DCL blended up to 50 percent hydrotreated vegetable oil (HVO) into the fuel used on its Magic and Dream class ships, including while the Disney Dream sailed in UK waters. HVO is a renewable diesel that is made from sustainable sources, including recycled cooking oils and waste animal fats. Operationalising HVO at scale represents Disney Cruise Line’s continued commitment to investing in new fuels that reduce emissions as the cruise line actively explores bio-LNG, green methanol and other fuel sources to encourage their development at scale within the maritime industry.

Disney Cruise Line coordinates itineraries to ensure shore-power-capable ships sail to ports of call that offer this technology. Using shore power reduces a ship’s emissions by relying on the port’s electric grid, instead of its engines, to power onboard systems like lighting and climate control. Furthermore, itineraries and ships’ sailing speeds are optimized across the fleet to conserve fuel and reduce emissions while continuing to provide an exceptional guest experience.

As part of The Walt Disney Company’s overall efforts to reduce the amount of single-use plastics, Disney Cruise Line has taken great measures to eliminate single-use plastics onboard and on Disney Castaway Cay, Disney’s private island destination in The Bahamas. This effort has resulted in removing an annual volume of more than 14.7 million plastic straws and 2.2 million plastic amenity containers. Disney Cruise Line has also gone from annually distributing nearly 1 million plastic merchandise bags fleetwide annually to nearly zero. Other measures include the removal of plastic cutlery, stirrers and condiment packets. Disney Cruise Line is committed to diverting waste from traditional waste streams. Shipboard recycling processes have helped to eliminate on average more than 2,900 tons of metals, glass, paper, cardboard and plastic from traditional waste streams each period.

Disney Cruise Line has invested in technology to ensure water purity and taken steps to select earth-friendly cleaners. Al Disney Cruise Line ships feature Advanced Wastewater Purification Systems (AWPS) that utilize natural processes to treat and purify on-board wastewater to levels far exceeding international shipping standards, and in some cases shore side potable water standards.

Since 1995, Disney has invested $125 million through the Disney Conservation Fund (DCF), a company initiative that supports community-based solutions to protect wildlife and their habitats. A core example of Disney Planet Possible-tangible actions the company is taking to inspire optimism for a brighter, more sustainable future-DCF philanthropic grants and the expertise of dedicated teams have helped to preserve and restore nature and biodiversity, build more resilient communities, advance science, and strengthen the natural systems that we all depend on for food, water, clean air, and more. In fiscal 2023, the DCF made nearly $7 million in grants, supporting organizations working the the ground in 18 countries.

In collaboration with Disney Cruise Line and Disney Conservation, a team of researchers has worked since 2007 to rehabilitate coral reefs in The Bahamas. In addition to cords, these reefs provide important habitats for other marine species, including endangers Nassau forever and lobster. Disney collaborated with other coral reef management and conservation leaders to establish of the Florida Coral Rescue Centre. This state-of-the-art facility located in Orlando safeguards vulnerable corals not yet affected by Stony Coral Tissue Loss Disease. The centre is the largest facility of its kind in the United States and is part of a national network coordinated by the Association of Zoos and Aquariums. Disney also support the Perry Institute for Marine Science to address coral conservation and restoration across The Bahamas alongside its more than 38 partner organizations. This investment includes major funding for a similar coral rescue centre based in Nassau.

More details on Disney Cruise Line’s dedication to minimizing its impact on the environment is available at: https://disneyconnect.com/dcl-press/fact/

More details on TWDC’s environmental goals can be found at: https://impact.disney.com/environment/environmental-sustainability/

e) The desirability of the Company maintaining a reputation for high standards of business conduct

We are committed to operating our businesses with integrity and adopting governance policies that promote the thoughtful and independent representation of our stakeholders’ interests. The Board of Directors has adopted Corporate Governance Guidelines which address, among other things, the composition and functions of the Board of Directors. Our Board of Directors is also expected to uphold our Code of Business Conduct. Similarly, the Group Company’s Standards of Business Conduct are applicable to all Cast Members of the Company including Board Members.

We regularly engage our leaders and Cast Members on these Standards through training and other forms of communication. It is compulsory that al office based Cast Members complete the mandatory online courses, examples include: Standards of Business Conduct, Bribery and Avoiding Corrupt Business Practices.

Acting responsibly and conducting our business ethically is an integral part of our brand.

f) The need to act fairly as between members of the Company

We are a wholly owned subsidiary of Wedco EMEA Ventures Limited, whose ultimate parent Company is The Walt Disney Company (TWDC), Magical Cruise Company is consolidated within TWDC results as part of the Disney Parks, Experiences, and Products Segment. Our parent company as well as TWDC are aware of key decisions and financial performance of the Company and take a keen interest in the strategies and future outlook of the Company.

Non-financial and sustainability information statement

1. Introduction

Effective for periods commencing on or after 6 April 2022, the Climate-related Financial Disclosure Regulations 2022 (“Regulations”) were introduced in the UK, requiring certain qualifying companies to report on principal climate-related matters and their impact on the business. For the period ended 1 October 2023, Magical Cruise Company Limited, trading as Disney Cruise Line (the “Company”) is required to comply with the Regulations for the first time.

This disclosure has been prepared in accordance with the new Regulations and provides the required information.

The main activity of the Company is providing travel experiences on cruise ships and in various coastal locations. The Company is actively monitoring the potential climate-related risks (physical and transition) and opportunities (as indicated in section 3 below), that could reasonably be expected to impact the Company. As one part of its strategy to mitigate the risk, the Company contributes to the Group’s science-based climate-related targets.

2. Governance

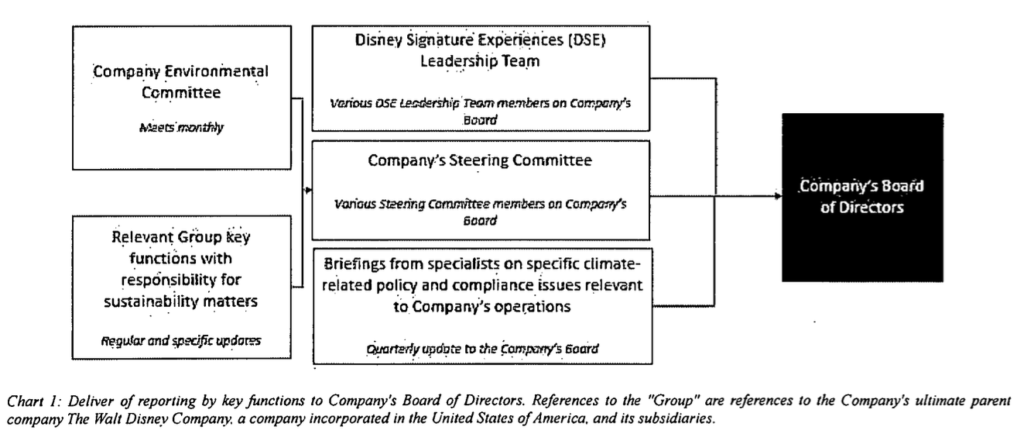

The Company has a number of people working in key functions, responsible for assessing and managing day-to-day climate-related risks and opportunities associated with its business. This includes a group dedicated to safety, security and environmental sustainability, a group dedicated to maritime and engineering operations and a group dedicated to port strategy. These teams, amongst others, provide regular updates to the Steering Committee or the relevant members of the Disney Signature Experiences (DSE) Leadership Team, as outlined below.

A distinct Company Environmental Committee also meets monthly. This Committee includes representation from a number of expert functions, including but not limited to the Vice President of Safety, Security and Environmental Policy and Compliance, Environmental Compliance Managers, Environmental Technical Auditors, Island Environmental and Operations Directors and Managers, Safety Managers, Nautical and Marine Operations managers, Senior Vice President for Global Maritime and Engineering Operations, Legal and an environmental officer from each of the Company’s ships, amongst others. The Environmental Committee meeting identifies, assesses and manages specific climate-related risks, planning, compliance, and practice and informs the Steering Committee on environmental and climate-related matters.

As outlined in the above chart, a Steering Committee for the Company meets weekly and includes representatives from all core business functions within the Company, including but not limited to Legal and Global Affairs, Marine and Engineering, Marketing, Revenue Management, Digital, Hotel operations, Entertainment, Risk Management, Finance, Security, Strategy, New Build, and Dry Dock. Three members of the Steering Committee are also on the Company’s Board of Directors. As outlined above, the Steering Committee is briefed by the lead for the Company Environmental Committee and discusses management of climate-related issues, including but not limited to fuel efficiency and energy conservation, waste minimisation, water purification, environmental efforts, weather response, risk planning and strategy, as applicable.

The work of the Steering Committee is complemented by that of the DSE Leadership team, which comprises two members of the Company’s Board of Directors and meets weekly. The DSE Leadership team considers the long-term strategy of the Company, including environmental policy and compliance relevant to the Company’s operations. The DSE Leadership Team is briefed by the Vice President of Safety, Security and Environmental Policy and Compliance on climate-related risks and opportunities.

During FY23 the Directors of the Company’s Board were formally updated on climate-related, environmental and sustainability matters in December 2022 by the Vice President of Safety, Security and Environmental Policy and Compliance. Topics covered included emissions and fuel, water, waste, sustainable design, and biodiversity.

The Company’s ultimate parent company is The Walt Disney Company, a company incorporated in the United States of America, whose Board of Directors is responsible for oversight and governance of Environmental, Social and Governance (“ESG”) programs and reporting for the Walt Disney Company and its subsidiaries (the “Group”).

The Walt Disney Company’s Board of Directors has established committees to facilitate and assist in the execution of its responsibilities. The Governance and Nominating Committee, Audit Committee and Compensation Committee are comprised entirely of independent Directors. The Walt Disney Company posts the charters of each of these committees on its website.

Corporate functions at Group level lend their expertise to assessing and managing climate-related risks and opportunities for the Company, including but not limited to corporate level management responsible for insurable risk, security and financial governance in the Group’s finance organisation, and for govemment affairs, environmental sustainability, public policy and compliance in Legal and Global Affairs organisation; and by the Group’s Risk Management Committee.

The Group’s Risk Management Committee is chaired by the General Counsel and Chief Legal and Compliance Officer and the Chief Financial Officer. It is responsible for overseeing and supporting the Company’s ongoing efforts to identify, assess and prioritise, manage, and monitor its enterprise risk.

The Group’s Global Public Policy Environmental Sustainability Team collaborates across the enterprise to set Group environmental goals and policies. The Global Public Policy Environmental Sustainability team at Group level also interacts with the Company’s Safety, Security, Environmental Policy, and Compliance team. These teams together have responsibility for oversight of the Company’s efforts towards meeting the Group’s environmental goals.

Leadership and key functions with responsibility for environmental sustainability matters at both Company and Group level collaborated throughout FY23, including on strategies related to climate-related risk management. As outlined below, the Company is in the process of formalising its company-level climate-related governance structure. This includes forming an advisory committee on climate-related matters and increasing the frequency of updates on climate-related issues to the Company’s Board, and appointing a Board Director with oversight of climate, environment, and sustainability-related issues. That said, some aspects of governance and planning for climate risks is already occurring. This includes but is not limited to governance around purchasing of lower carbon fuels, supporting the Group’s emissions reductions goals, and other matters.

3. Risk Management

Overview

The Company is responsible for identifying climate-related risks and opportunities, including those that impact its business over the short, medium and long-term through regular policy and business assessments with the input of relevant teams from the Group including those with responsibility for Environmental Sustainability, Legal and Global Affairs, Finance and ESG reporting. It employs a mix of general risk management tools and other tools specific to understanding climate impacts. It identifies significant physical and transition risks and opportunities through multi-disciplinary management, market-based assessment, qualitative scenario analysis, and other tools and approaches. For example, the Company maintains a risk register through which climate risks are assessed and managed in the context of operational hazards such as extreme weather events on cruise routes. This is done via a Continuity Planning Tool that is managed by the Company’s Vice President of Safety, Security, and Environmental Policy and Compliance.

To manage the potential financial impact of potential risks, and support business continuity, the Group uses risk financing strategies including self-insurance, contractual risk transfer, commercial insurance, portfolio diversification and alternative risk financing techniques. The Group’s Enterprise Risk Management function provides insights by working across the entire Group, together with business segments and units to help identify, assess, and mitigate operational risks-including those related to environmental matters-with these risk financing strategies. In addition, the Company addresses risks specific to climate through asset planning, resilience planning, and through emissions reduction efforts in support of the Enterprise emissions reduction targets. Please refer to Section 5 for further detail on the Group’s targets, the Company’s targets, and performance against those targets.

Risk Identification Process

In 2023, the Company engaged an independent third party to assist in its assessment of climate-related risks and opportunities across the short, medium and long-term. The Company and relevant legal and public policy teams in the Group track emerging climate-related policies and regulations in sectors and regions where it operates to plan for emerging requirements and manage disruption and cost to the business.

In December 2023 and the first calendar quarter of 2024, the Company conducted a dedicated climate risk and opportunity identification and assessment process to augment its regular, ongoing assessment of risks and opportunities. As part of this analysis, the Company’s operations and strategies were assumed to remain at 2023 levels, however the model assumed that the cruise industry adapted to the evolving temperature pathways over the short to long-term time horizon.

The process began with an inventory of potential risks and opportunities based on multiple sources including the mandatory climate-related financial disclosures by publicly quoted companies, large private companies and LLPs non-binding guidance, the Taskforce on Climate-Related Financial Disclosures Implementation Guidance, input from an external expert firm and from relevant experts inside the Company. The inventory included transition risks associated with potential regulatory and market shifts associated with a transition to a low-carbon economy, and opportunities arising from efforts to mitigate and adapt to climate change (e.g. low carbon products, new markets and energy savings). It also considered physical risks associated with potential exacerbation of physical hazards associated with climate change.

Transition risks considered included:

- Shifts in labour prices

- New mandates and regulations

- Reduced spend by customers

- Increased carbon pricing

- Increased cost of raw materials

- Changes in energy and fuel costs

- Uncertainty in policy continuity

- Reputational risks associated with environmental matters

- Fluctuating travel costs

- Changes in business seasonality

Supply chain risk for third parties

Non-financial and sustainability information statement (continued)

3. Risk Management (continued)

Risk Identification Process (continued)

Physical risks considered included:

- Wind

- Thunderstorm

- Precipitation

- Flood

- Hail

- Heat •

- Drought

- Wildfire

- Cold

Risk Assessment Process

Following a broad business review which considered the potential impacts of all the above to the Company’s business, a long-list of potential climate-related transition and physical risks and opportunities were identified for further evaluation. A review was conducted using relevant Group and Company documents and data, supplemented with internal experts’ judgement, to develop this long-list. Consideration was given to the potential impacts of the above-mentioned risks and opportunities to the Company’s business. The potential financial impacts of these risks and opportunities were assessed against the relevant elements of the Company’s Income Statement and Statement of Financial Position, in addition to other factors including the ownership structure of physical sites and how critical these sites are to the Company.

A series of internal workshops was then conducted in light of the above, with cross-functional experts from the Company, the Group and external advisors, to refine the long-list into a short-list of potential principal climate-related risks and opportunities.

At this stage, the assessment did not consider actions aiready in place or being considered to mitigate risks or take advantage of opportunities.

These short-listed risks and opportunities were carried forward for detailed risk mapping and scenario analysis across three dimensions:

- Impact: the potential financial impact of the risk or opportunity

- Likelihood: the probability of the risk or opportunity occurring

- Timeframe: potential trends associated with the risk or opportunity, over three-time horizons (see table below)

| Timeframe | Definition | Rationale |

|---|---|---|

| Short | 2023 | Aligned to the timing of the Company’s forecasting and planning process and the Group’s 2030 environmental goals. |

| Medium | 2040 | Aligned with timing of the Company’s medium term forecast and planning process. |

| Long | 2050 | Aligned with UN (United Nations) net-zero emissions goal time horizon. |

The process taken for scenario analysis of shortlisted risks and opportunities included but was not limited to:

- Use of economic projections from a third party’s Integrated Assessment Model (IAM) to help provide projections for potential fuel price increases and carbon taxes in different climate scenarios.

- Use of a third party physical risk analysis to help provide projections for potential physical risk impacts in different climate scenarios.

4. Principal Risks

Based on this assessment and related scenario analysis, the Board of Directors has concluded that the Company faces three principal physical risks and three principal transition risks, per table 4.1. The rationale for selecting these risks is provided ni table 4.2. as well as the Board of Director’s view on the actual and potential impacts on its business model and strategy is provided in 4.3.

Table 4.1

| # | Risk Type | Principal Risk |

|---|---|---|

| 1 | Transition | Risk from increased fuel price |

| 2 | Transition | Risk from direct carbon pricing mechanisms |

| 3 | Physical | Risk of site damage from climate hazards in Bahamas |

| 4 | Physical | Risk of business interruption from exposure to physical climate hazards in Bahamas |

| 5 | Physical | Risk of business interruption from exposure to physical climate hazards in Florida |

| 6 | Transition | Risk of cruise travel demand reduction due to consumers’ changing climate values |

Table 4.2

| # | Principal Risk | |

|---|---|---|

| 1 | Risk from increased fuel prices | Fuel is a significant portion of overall costs. The Company currently uses a range of fuels including Marine Diesel Oil (MDO), Liquified Natural Gas (LNG) and Hydrotreated Vegetable Oil (HVO). The Company is also exploring potential use of green methanol. Each faces price pressure. Lower carbon fuels such as HVO and green methanol come with some price premiums and also face price pressure because supply may remain low as the nascent industry develops, and demand is likely to grow, as many players in marine shipping and cruise line seek to actively decarbonize. Fossil-fuels such as MDO and LNG could experience significant price increases primarily driven by the adoption of carbon pricing mechanisms. |

| 2 | Risk related to direct carbon pricing mechanisms | The Company operates in jurisdictions with mandatory carbon pricing mechanisms, with some jurisdictions implementing measures on a relatively fast timeline. For example, the European Union Emissions Trading System (“EU ETS”) has included the maritime sector from 2024, and this is already leading to increased costs based on emissions related to the Company’s EU sailings. In addition, the IMO 2023 strategy for Greenhouse Gas (“GHG”) emissions reduction calls for global pricing mechanisms to reduce the gap between sustainable and convention fuels. Actual carbon prices may be different in different regions. |

| 3 | Risk of site damage from climate hazards in The Bahamas | The Company has an investment in a subsidiary which owns two port destinations in The Bahamas: Castaway Cay and Lookout Cay. Castaway Cay has already faced site damage due to hurricanes. Lookout Cay is open as of June 2024, and potentially faces similar exposure to hurricane-related hazards. |

| 4 | Risk of business interruption from exposure to physical climate hazards in The Bahamas | The Company operates a significant number of cruise routes to and around two destinations in the Bahamas, Castaway Cay and Lookout Cay. Castaway Cay has previously faced business interruption due to hurricanes, while Lookout Cay, which has just opened, faces similar exposure to hurricane-related business-interruption hazards. There is a risk that business interruption due to physical climate hazard may impact sailings and potentially revenue streams of the Company. |

| 5 | Risk of business interruption due to exposure to physical climate hazards in Florida | The Company relies on three main sites in Florida: A Cruise terminal at Port Canaveral in coastal Central Florida; a Cruise terminal at Port Everglades in coastal South Florida; and a headquarters office in Celebration in inland Central Florida. While the Company does not own these locations, each has previously faced the impact of hurricanes. Each of these Florida locations face business interruption risk that could remain significant or worsen as a result of climate change. Many of the Company’s itineraries depart from these terminals and sail in Caribbean waters that experience hurricanes. Business interruptions in the form of forced cancellations, rescheduling and rebooking of sailings have already occurred. |

| 6 | Risk of cruise travel demand reduction due to consumers’ changing climate values | Ticket sales constitute most of the Company’s total revenue and are potentially at risk if there is reduction in cruise sector activity as a result of environmental concerns. While this is not evident in consumer interest and bookings today, the Company expects some consumers may evaluate climate impacts of different travel options, reducing demand for long-distance travel or travel in hard to abate sectors like air travel and large ship cruising. |

Table 4.3

| # | Principal risk | Impacts on the Company’s business model and strategy |

|---|---|---|

| 1 | Risk from increased fuel prices | There are two main impacts of the risk of increased fuel prices on the Company’s business model and strategy: (A) the Company’s use of multiple levers to reduce fuel use and emissions throughout the fleet; and (B) the Company’s use of multiple methods to reduce exposure to fuel price fluctuations through fuel supply diversification. A. The Company employs several levers to reduce fuel use and GHG emissions, as part of a comprehensive emissions reduction strategy. For example: (1) New ship energy efficiency. The Company added the Disney Wish to the fleet in 2022 and this ship class is designed to comply with the more stringent Energy Efficiency Design Index (EEDI) that is required by the International Maritime Organization. EEDI requires that new build ships attain a 5 percent calculated reduction in emissions based on the 2008 baseline. Some of these design standards include enhanced hull hydrodynamic design, waste heat recovery, and efficient lighting systems. (2) Existing ship energy efficiency. The Company has established energy efficiency programs that extend beyond the new build program and have been integrated into the operation of the existing fleet. Each ship class has implemented a variety of programs aimed to improve energy and fuel efficiency. Similarly to the EEDI, al existing ships have been assigned an Energy Efficiency Existing Ship Index (EEXI), which is an assessment of the ship’s efficiency based on its current design and installed equipment. The EEXI sets a specific limit on propulsion power for each ship that is designed to limit, by operational control, a ship’s emissions. The EEXI is determined by the ship’s classification society, Lloyd’s Register in the case of the MCCL fleet, and approved by The Bahamas Maritime Authority. A ship may only exceed the power limits in emergency conditions. a) Throughout the Company’s fleet, efforts have been initiated to reduce energy demand with an emphasis on lighting improvements and Heating Ventilation and Cooling (HVAC) upgrades. Conventional lighting in the ships have been replaced with LED lighting. Waste heat generated for propulsion is recycled to improve the efficiency of the HVAC cooling process. Additional efficiency enhancement projects are in process, focused on a variety of onboard systems, ranging from reverse osmosis to projection systems. b) Ships have also implemented efficiency projects focused on propulsion including propeller enhancements, propulsion control, and reducing friction. The Disney Magic and Disney Wonder have implemented an Air Lubrication System which creates bubbles along the hull to decrease the friction between the hull and water. Ships have also implemented new hull coatings to remove biofouling to reduce drag and the Company has implemented a fleetwide system of routine hull cleaning to continuously remove hull growth which results in friction and inefficiency. Innovative hull cleaning technologies are being explored through the Company’s Research and Development program. (3) Increasing shore supplied electricity. Shore supplied electricity (SSE) provides an excellent opportunity to reduce emissions and Disney Magic and Disney Wonder are configured to receive SSE wherever it is available. Currently, the only SSE available is on the US West Coast and Canada and in select ports in Europe. Disney Dream will be upgraded to be SSE capable in 2024, Disney Fantasy will be upgraded in 2025. The Group continuously evaluates the energy efficiency of land-based electricity grids to ensure that ships connected to SSE grids are more sustainable than the shipboard energy systems. (4) Using renewable electricity. The Company maintains two island locations in The Bahamas that generate renewable electricity through installed solar energy systems. The system at Castaway Cay was commissioned in 2023 and is generating a substantial amount of power for the facility. The Castaway Cay solar array and battery storage system provide the majority of the electricity currently consumed on the island, and the Company’s objective is to increase this to 100% by 2030. For Lookout Cay, which will begin operating in 2024, 90% of the destination’s electricity will come from renewable sources, increasing to 10% by 2030. Using renewable electricity reduces the demand for diesel fuel to be supplied from ships and trucks to power generators. Electrification of transportation, watercraft and other equipment is also being pursued to leverage the renewables on island. (5) Optimizing itineraries. Reducing fuel consumption by optimizing itineraries for fuel efficiency is another lever employed by the Company. Ships engines have optimal loads for efficiency, that translate to a range of speed that is most efficient from an energy management perspective. Ships frequently select routes that avoid severe weather systems, which require significant increases in power to maintain navigation safety. Additional itinerary optimizations will be considered in the future to reduce speed and emissions. The implementation of facial recognition systems by US Customs and Border Protection (CBP) in the United States allows for the more efficient disembarkation of guests, improving the efficiency of port operations, and resulting in less port time and the potential for speed reduction by ships. These efforts are funded through standard short term operational budget allocations, secured long-term budgets, among others. B. The Company employs several levers to reduce exposure to fuel price fluctuations, while continuing to pursue its environmental goals (1) Fuel type diversification: The Company operates using three different fuel types, with scope for more in future. Hydrotreated vegetable oil (HVO) is an alternative to Marine Diesel Oil (MDO) and both products will be related to the same underlying markets and subject to the same price triggers. However, they do not move in parallel and therefore there is an opportunity for MCCL to adjust the type of fuel purchased based on price and taking into accounts its emissions goals. Purchase location can also affect the price differential, so there is further strategic opportunity in planning where to purchase each fuel type. The new vessels (one currently in operation, at least another two to follow) will operate using Liquified Natural Gas (LNG), the market rates of which do not necessarily reflect the rates of MDO. Therefore, by operating two distinct fuel types across the fleet, the Company can reduce its exposure to any price increase in one of those markets. a) Price hedging strategies: The Company is currently able to hedge Marine Diesel Oil (MDO) out of Port Canaveral and Port Everglades, securing effective prices for bunkers in these locations. Hedge policy prescribes a 90% hedge maximum within the fiscal year, the equivalent of approximately 50% of total MDO volume. The Company may hedge at least two years out, but the hedge policy maximum percentage is lower for future periods. Additionally, the Company can and has entered into fixed contract agreements with the Liquified Natural Gas (LNG) supplier, which has the same effect as a hedge. All LNG is currently delivered by a single supplier in Florida and therefore the Company is able to protect against price fluctuations on the vast majority of its LNG consumption (in current fiscal year). The Company continues to explore opportunities for hedging fuel in different locations. b) Fuel vendor diversification: Every year the Company negotiates with MDO suppliers in Port service from each prospective supplier. For locations around the world, the Company uses an agent to negotiate and source local fuel on their behalf. c) Securing future supply through offtake agreements: Due to the fledgling nature of the LNG market, the Company entered an agreement, following negotiations with different suppliers, to take a certain amount of volume over a period of ten (later revised to twelve) years from one particular supplier. This gave the supplier the confidence and security to invest in the necessary infrastructure, while the Company can rely on the availability of LNG for three new ships for the foreseeable future. A pricing structure for LNG deliveries was also put in place as part of this agreement. |

| 2 | Risk related to direct carbon pricing mechanisms | 1. During the period of transition of implementation to a carbon pricing mechanisms, the Company is evaluating different strategies to reduce financial exposure associated with the purchase of evaluating allowances taking into account that any imbalance in carbon pricing mechanisms may only be temporary. For example, a global pricing mechanism as is being considered by the IMO could potentially level the playing field among regions. The Company uses a minimum of a ten-year outlook when making fuel and efficiency project decisions, allowing for consideration of future carbon pricing impacts. 2. Notwithstanding the fact that the Company is implementing a comprehensive emissions reduction strategy, the Company will continue to face financial risk due to the carbon pricing mechanisms enacted by the European Union and in development by the IMO. While this financial risk is currently in effect in Europe, the implementation of a global pricing mechanism by 2027 by the IMO, could serve to create a uniform carbon pricing mechanism that will affect all operations. Therefore the emissions reduction strategy and resulting decrease in emissions, will reduce the related financial consequences of direct carbon pricing mechanisms. That said, even assuming the Company contributes to the group achieving its 2030 emissions reduction targets, there will still be expenses associated with purchase of carbon credits. These future carbon credit expenses have been incorporated into financial plans associated with the Group’s 2030 goals. In participating the EU Emissions Trading System (ETS), Italy was designated as the Administrative Authority for the Company, primarily based on the concentration of the Company’s operations from Italian ports and destinations. Allowances based on the quantity of emissions in Europe will be purchased and surrendered to the Administrative Authority based on 40% of emissions in 2024. The level of emissions allowances required to be purchased rises to 70% in 2025 and 100% in 2026. To reduce the volatility of exposure associated with allowances, the Company continuously assesses market timing and has locked in a specific amount of allowances based on the forecast emissions for 2024 associated with the deployment of the Disney Dream to Europe. |

| 3 | Risk of site damage from climate hazards in Bahamas | Castaway Cay facilities have a resilient design, specifically constructed ot mitigate the impact of severe weather events to allow for quick restoration and recovery. Permanent facilities (buildings, piers, and roads) are positioned above sea level and not currently modeled to be significantly at risk from sea level rise. Lookout Cay is constructed similarly. Both island destinations use a mix of sustainable energy (solar energy) and diesel fuel to generate electricity and power for vehicles. Both island destinations have maximized the use of natural surroundings to protect constructed facilities and prevent erosion of the sand and land features. |

| 4 | Risk of business interruption from exposure to physical climate hazards in Bahamas | As an element of the company’s continuity of operations program, the Company remains aware of severe weather systems that may affect ship and island operations. The Company maintains a 24-hour operations centre in Florida as an alert and notification centre that is focused on al hazards that could potentially impact the Company operations. in the event that severe weather poses a risk to a ship’s itinerary, a multi-disciplinary executive team (the Crisis Management Team) convenes to establish an alternative itinerary to avoid hazard. Because ships are highly mobile, itineraries may be adjusted significantly to ensure that the ship operates well away from any hazard. The Hurricane season in the Southeast United States and Caribbean Sea currently extends from June 1 to November 30, and the collective international government and business sectors throughout the region have developed extensive programs to prepare for and respond to natural disasters. |

| 5 | Risk of business interruption due to exposure to physical climate hazards in Florida | When a severe weather system poses a risk to operations in Florida, the Company’s ships move in a coordinated fashion with other cruise ships to avoid the impacted port and shift to another if the primary port is unusable, thereby reducing or mitigating service disruption. Based on the geographic dispersion of Port Canaveral, Port Everglades, and Celebration, the system has the option to divert cruises. |

| 6 | Risk of cruise travel demand reduction due to consumers’ changing climate values | The Company has employed a long-established record focused on environmental programs. These innovative initiatives include commitments to biodiversity, minimizing impact on freshwater sources, from the cruise industry due to environmental concerns, it would be anticipated that the Company’s long history of dedication to the environment would help mitigate shifts faced by the other members of the industry. |

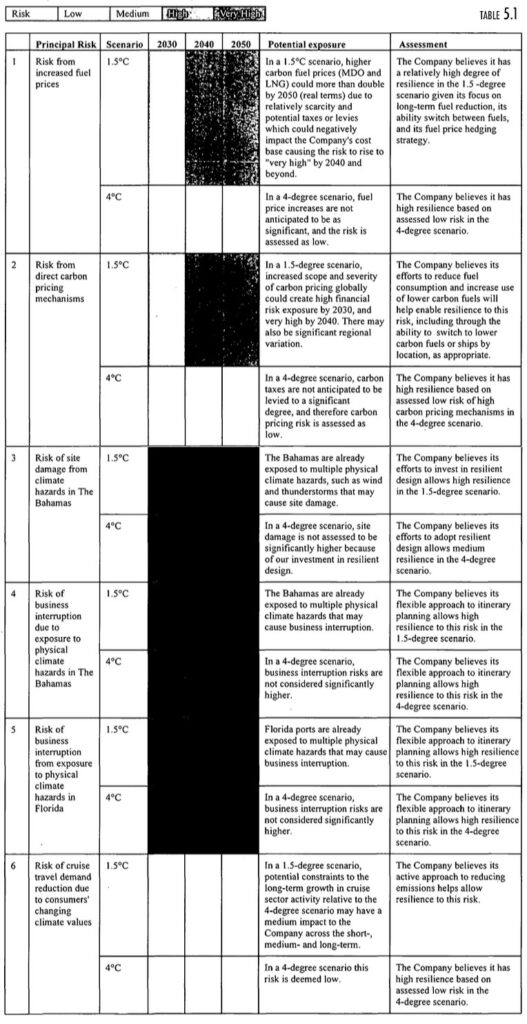

5. Strategy

The Company’s strategy to mitigate its principal risks has been developed using an understanding of current risks facing the Company. However, the Company has also considered these risks under two hypothetical climate scenarios with varying consequences:

- A relatively low carbon future with global temperature increase constrained to 1.5°C. and substantial socio-economic transition and policy changes.

- A relatively high carbon future with global temperature increase of 4°C and substantially more severe physical risks.

These scenarios correspond to IPCC (Intergovernmental Panel on Climate Change) Representative Concentration Pathways (RCP) 4.5 and 8.5 respectively and were chosen to reflect two significantly different hypothetical futures, each with very different potential operational and financial impacts. The Company’s scenario analysis was qualitative in nature and its assessment of potential impact was limited to the extent to which the above trends could change over time through to 2050. The potential consequences from transition measures which might be anticipated within the 1.5°C scenario were assessed relative to a counterfactual baseline 4°C scenario.

While the Company has not completed a full quantitative assessment of the potential financial consequences of these risks, it has estimated ranges of potential financial consequence based on broad assumptions in these hypothetical future scenarios.

The Company continues to monitor and assess these risks as they develop, but based on its current qualitative assessment, the Board of Directors considers that the Company has adequate mitigating measures in place to manage the impact of these physical and transitional risks. As such, the Board of Directors considers the Company’s business model and strategy are resilient to both of these potential scenarios, as detailed in table 5.1.

Table 5.1

The risk matrix used to assign low to very high risk uses following variables:

- Impact: the extent to which a risk event could affect the Company’s organization’s objectives and strategy. in this case we qualitatively assessed potential financial impact.

- Likelihood: Refers to the potential probability of a risk event occurring.

The risk rating is based on a potential qualitative impact rating using the following logic:

Potential qualitative impact rating =Contribution to P&L %( costs or profit potentially at risk) X Variance between 1.5°C and 4°C scenarios (% difference between two scenarios)

6. Metrics and Targets

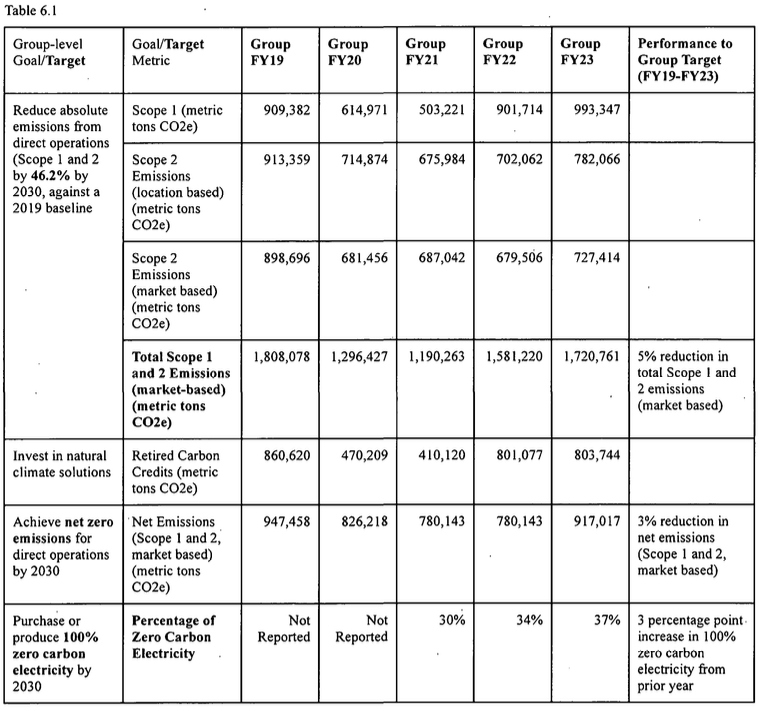

The Company contributes to climate-related targets established at the Group level.

At the Group level, there has been a long-term goal set in 2009 to achieve net zero greenhouse gas emissions from direct operations (Scope 1’and 2) by 2030, and the Company remains committed to this goal.

In alignment with the Intergovernmental Panel on Climate Change and the Paris Climate Agreement, the Group has set quantitative and timebound absolute reduction goals for emissions from its direct operations (Scope 1 and 2), and absolute reduction and supplier and licensee engagement goals for emissions from its value chain (Scope 3). In calendar 2023, these goals were validated by the Science Based Targets Initiative (SBTi).

At Group level, metrics have been developed for scope 1 and 2 targets and performance has been tracked since 2009. The Group has initiated efforts to disclose Group-level scope 3 emissions, but has not yet started to share data for the immediately preceding performance year. The Group intends to do this in future periods.

By driving reductions in the overall Group-level carbon footprint, emissions targets help the Company manage the risks associated with fuel prices, carbon taxes and ticket sales. The Company has also set a target and key performance indicators for risks associated with business interruption associated with site damage in The Bahamas.

Group-level goals and targets associated with emissions from its direct operations (scope I and 2)

- Reduce absolute emissions from direct operations (Scope | and 2) by 46.2% by 2030, against a fiscal 2019 baseline.

- Achieve net zero emissions for direct operations by 2030.

- Purchase or produce 100% zero carbon electricity by 2030.

- Invest in natural climate solutions (in sufficient quantities to reach net zero in 2030 after 46.2% absolute reduction).

Group-level goals and targets associated with emissions from its value chain (scope 3)

- Reduce Scope 3 emissions through absolute reduction and supplier and licensee engagement:

- Reduce absolute Scope 3 GHG emissions from purchased goods and services, capital goods, fuel- and energy-related activities, upstream transportation and distribution, waste generated in operations, business travel, employee commuting, and franchises, by a minimum of 27.5% by 2030 against a fiscal 2019 baseline