The Walt Disney Company stock closed for the day at $84.50 a share before reporting company earnings for the fourth quarter (Q4) and full fiscal year 2023 which ended on September 30, 2023.

Revenues for the quarter and year grew 5% and 7% compared to the prior-year quarter and prior year, respectively. Diluted earnings per share (EPS) from continuing operations for the quarter increased to $0.14 from $0.09 in the prior-year quarter and for the year, decreased to $1.29 from $1.75 in the prior year. Excluding certain items, diluted EPS for the quarter increased to $0.82 from $0.30 in the prior-year quarter and for the year, increased to $3.76 from $3.53 in the prior year.

“Our results this quarter reflect the significant progress we’ve made over the past year,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company. “While we still have work to do, these efforts have allowed us to move beyond this period of fixing and begin building our businesses again. We have a solid foundation of creative excellence and innovation built over the past century, which has only been reinforced by the important restructuring and cost efficiency work we’ve done this year, and we’re on track to achieve roughly $7.5 billion in cost reductions. Combined with our portfolio of valuable businesses, brands and assets – and the way we manage them together – Disney has a strong hand that differentiates us from others in our industry.

“As we look forward, there are four key building opportunities that will be central to our success: achieving significant and sustained profitability in our streaming business, building ESPN into the preeminent digital sports platform, improving the output and economics of our film studios, and turbocharging growth in our parks and experiences business. We have already made considerable advancements in these four areas and will continue to move forward with a sense of purpose and urgency, and I’m bullish about the opportunities we have before us to create lasting growth and increase shareholder value.”

Disney+ added nearly 7 million core subscribers in the fourth quarter. Key streaming content in the quarter included theatrical titles Elemental, Little Mermaid and Guardians of the Galaxy Vol. 3., original series Ahsoka and the Korean original series Moving. The company continues to expect their combined streaming businesses will reach profitability in Q4 of FY24, although progress may not look linear from quarter to quarter.

Domestic ESPN revenue and operating income grew year over year in both fiscal year 2022 and fiscal year 2023, demonstrating the value of sports and the power of the ESPN brand.

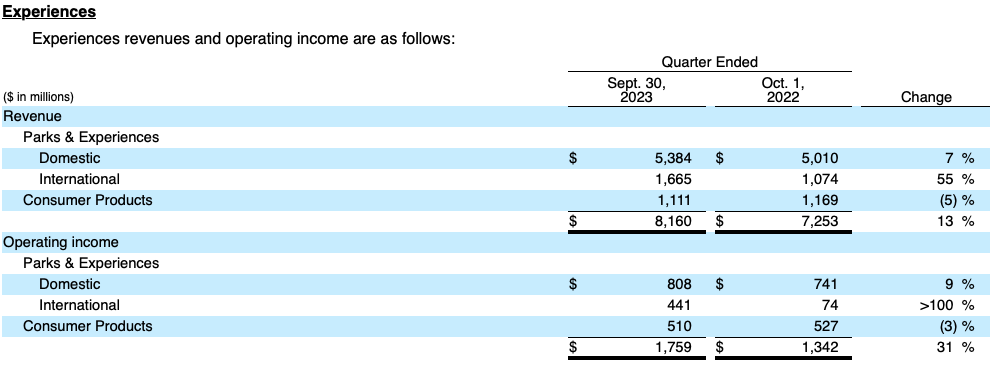

Experiences operating income increased by over 30% versus the prior-year quarter, with year over year growth across all international sites, Disney Cruise Line, Disney Vacation Club and Disneyland Resort. At Walt Disney World, Disney continues to manage against wage inflation and challenging comparisons to the prior year from the 50th anniversary celebration. Disney continues to aggressively manage their cost base, and have increased annualized efficiency target to $7.5 billion, versus $5.5 billion previously.

Disney says they expect to grow free cash flow in fiscal 2024 significantly versus fiscal 2023, approaching levels last seen pre-pandemic. This continued robust free cash flow growth, alongside our strong balance sheet, will position The Walt Disney Company well to address their investment and shareholder goals for the year and going forward.

The Experiences segment (which includes Disney Cruise Line) saw an increase in operating income at their domestic parks and experiences was due to growth at Disney Cruise Line resulting form increase in passenger cruise days and average ticket prices. Additional an increase at Disney Vacation Club attributable to sales of The Villas at Disneyland Hotel in the current quarter.

Lower results at Disney’s domestic parks and resorts, which reflected a decrease at Walt Disney World resulting from higher costs attributable to accelerated depreciation related to the closure of Star Wars: Galactic Starcruiser and inflation and to a lesser extent, lower guest spending driven by a decrease in average daily hotel room rates.

Growth at Disneyland Resort due to higher attendance, increased guest spending primary driven by higher average ticket prices, and higher costs due to inflation.

International Parks and Experience saw higher operating result attributed to an increase in operational results at Shanghai Disney Resort stemming from guest spending on increased average ticket prices as well as higher attendance.

Higher operating income at Hong Kong Disneyland Resort attributable to guest spending growth due to an increase in average ticket prices, higher volumes resulting from increases in attendance and occupied room nights. Results reflected 81 days of operations in the current quarter compared to 65 days in the prior-year quarter. Increased costs primarily attributable to new guest offerings and inflation.

There were no additional details regarding Disney Cruise Line in the press release. We will update this post if we hear anything during the earnings call and Q&A.

For more information and an overall report click over to the Q4-2022 Earnings Report.