The Walt Disney Company stock closed for the day at $99.27 a share before reporting their earnings for the first quarter (Q1) of fiscal year 2024 which ended on December 30, 2023. According to the earnings report, revenues for the quarter were comparable to the prior-year quarter at $23.5 billion. Diluted earrings per share (EPS) for the quarter increased to $1.04 from $0.70 in the prior-year quarter. Excluding certain items, diluted EPS for the quarter increased to $1.22 from $0.99 in the prior-year quarter.

Just one year ago, we outlined an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company. “Our strong performance this past quarter demonstrates we have turned the corner and entered a new era for our company, focused on fortifying ESPN for the future, building streaming into a profitable growth business, reinvigorating our film studios, and turbocharging growth in our parks and experiences.

“As we build for the future, the steps we are taking today lend themselves to solidifying Disney’s place as the preeminent creator of global content. Looking at the renewed strength of all of our businesses this quarter – from Sports, to Entertainment, to Experiences – we believe the stage is now set for significant growth and success, including ample opportunity to increase shareholder returns as our earnings and free cash flow continue to grow.”

Disney’s first quarter earnings results reflect the progress the company made in their strategic transformation, as they continue to build from a position of strength. Disney say they are achieving significant cost reductions across their businesses, as evidenced by the realization of over $500 million in selling, general and administrative and other operating expense saving across the enterprise in the first quarter.

Disney is on track to meet or exceed the company’s $7.5 billion annualized savings target by the end of fiscal 2024, while we continue to look for further efficiency opportunities. Based on the strength of first quarter results as well as our expectations for the balance of the year, Disney expects full year fiscal 2024 earnings per share excluding certain items to increase by at least 20% versus 2023, to approximately $4.60. Further, Disney continues to expect free cash flow generation in fiscal 2024 to total roughly $8 billion.

Disney continues to expect to reach profitability at their combined streaming businesses in the fourth quarter of fiscal 2024, and are making tremendous progress in this area, with first quarter Entertainment DTC operating losses improving by nearly $300 million versus the prior quarter. Disney believes this business will ultimately be a key earnings growth driver for the Company. Hulu subscribers increased by 1.2 million from the prior quarter. Disney+ Core subscribers decreased sequentially by 1.3 million, in line with prior guidance and reflecting a substantial price increase in the quarter as well as the end of the global summer promotion.

Disney+ Core ARPU increased sequentially by $0.14 versus the fourth quarter. The company expects Disney+ Core subscriber net additions of between 5.5 and 6 million and ongoing positive momentum in ARPU in the second quarter. ESPN’s domestic business grew both revenue and operating income year over year in the first quarter, and we continue to build ESPN into the world’s preeminent digital sports platform.

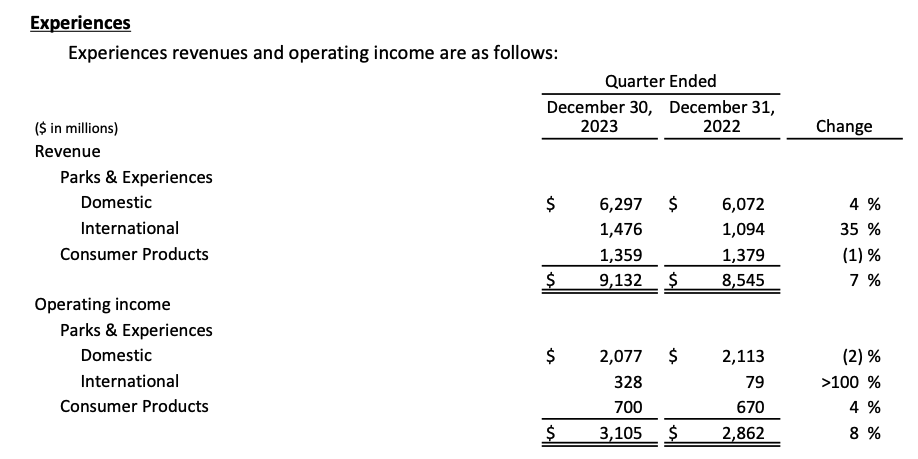

At Experiences, the company generated all-time records in revenue, operating income, and operating margin in the first quarter, and the company recently celebrated the well-received openings of World of Frozen at Hong Kong Disneyland Resort and Zootopia at Shanghai Disney Resort.

In February 2024, the Board of Directors approved a new share repurchase program effective February 7, 2024; Disney plans to target $3 billion in repurchases in fiscal 2024. The Board also declared on February 7, 2024 a cash dividend of $0.45 per share – an increase of 50% versus the last dividend paid in January – payable July 25, 2024 to shareholders of record at the close of business on July 8, 2024.

The Experiences segment (which includes Disney Cruise Line) saw a decrease in operating income at the company’s domestic parks and experiences reflected lower results at Disney’s domestic parks and resorts, largely offset by higher results at Disney Cruise Line.

At Disney’s domestic parks and resorts, lower results in the current quarter compared to the prior year were due to a decrees at Walt Disney World Resort reflecting a modest decrease in revenues and higher costs. These impacts were due to lower volumes due to decreases in attendance and occupied room nights, both of which reflected the comparison to the 50th anniversary celebration in the prior-year quarter, higher costs due to inflation, partially offset by cost saving initiatives and lower depreciation, increased guest spending due to higher average ticket prices, partially offset by lower average daily room rates.

Results at Disneyland Resort were comparable to the prior-year quarter as revenue growth was largely offset by an increase in costs. These impacts were attributable to an increased guest spending primarily due to higher average ticket prices, attendance growth

and higher costs driven by inflation.

Growth at Disney Cruise Line was due to increases in average ticket prices and passenger cruise days, partially offset by higher costs.

There were no additional details regarding Disney Cruise Line in the press release. We will update this post if we hear anything during the earnings call and Q&A.

For more information and an overall report click over to the Q1-2024 Earnings Report.

Up next for The Walt Disney Company is the Annual Meeting of Shareholders on April 3rd.