The Walt Disney Company stock closed for the day at $87.51 a share before reporting their earnings for the third quarter (Q3) of fiscal year 2023 which ended on July 1, 2023. According to the earnings report, revenues for the quarter grew 4%.

Our results this quarter are reflective of what we’ve accomplished through the unprecedented transformation we’re undertaking at Disney to restructure the company, improve efficiencies, and restore creativity to the center of our business,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company. “In the eight months since my return, these important changes are creating a more cost- effective, coordinated, and streamlined approach to our operations that has put us on track to exceed our initial goal of $5.5 billion in savings as well as improved our direct-to-consumer operating income by roughly $1 billion in just three quarters. While there is still more to do, I’m incredibly confident in Disney’s long-term trajectory because of the work we’ve done, the team we now have in place, and because of Disney’s core foundation of creative excellence and popular brands and franchises.

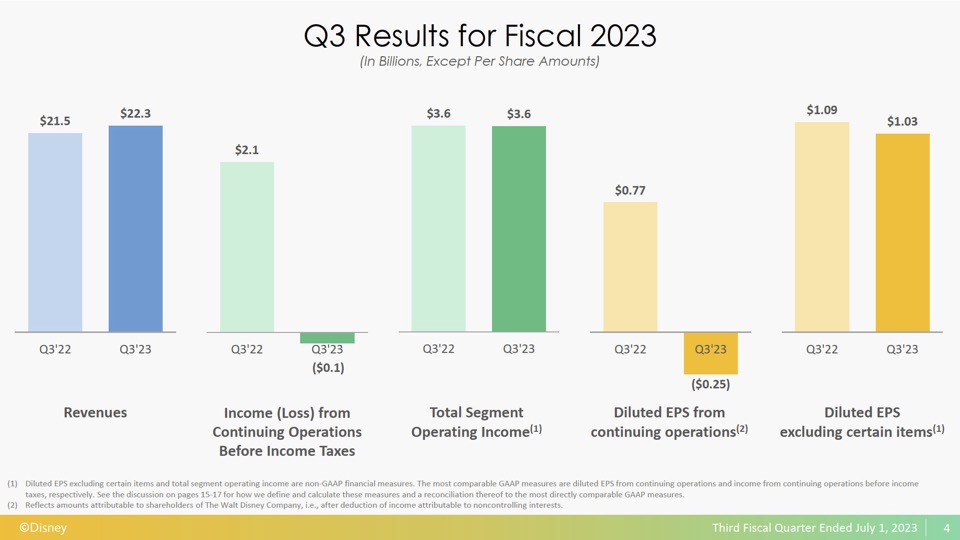

Diluted earnings per share (EPS) from continuing operations for the quarter was a loss of $0.25 compared to income of $0.77 in the prior-year quarter. Excluding certain items, diluted EPS for the quarter was $1.03, down from $1.09 in the prior- year quarter. EPS from continuing operations for the nine months ended July 1, 2023 decreased to $1.14 from $1.66 in the prior-year period. Excluding certain items, diluted EPS for the nine months ended July 1, 2023 decreased to $2.94 from $3.22 in the prior-year period.

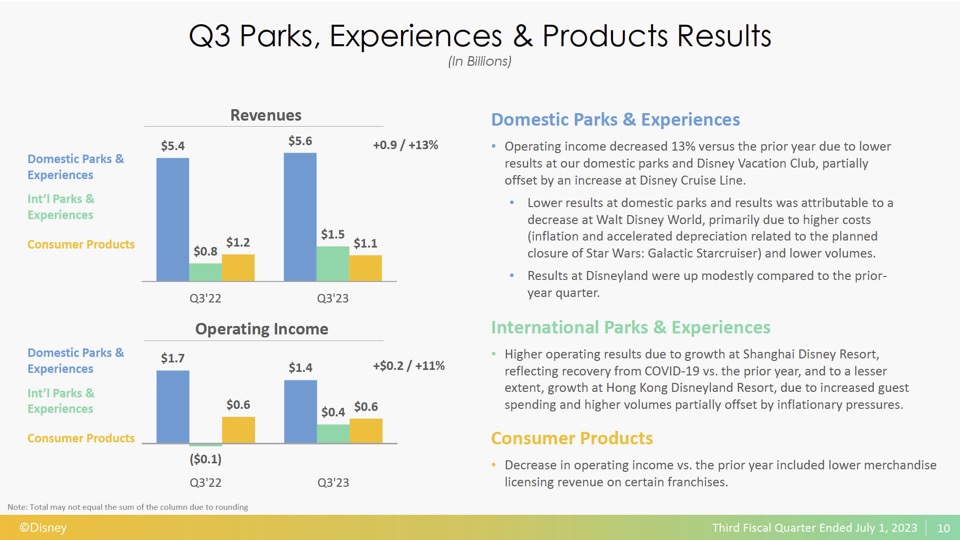

The Parks, Experiences and Products segment (which includes Disney Cruise Line) saw revenues for the quarter increased 13% to $8.3 billion, and segment operating income increased 11% to $2.4 billion. Higher operating results for the quarter reflected increases at Disney’s international parks and resorts, partially offset by lower results at Disney’s domestic operations and, to a lesser extent, our merchandise licensing business.

Higher operating results at Disney’s international parks and resorts were due to growth at Shanghai Disney Resort and, to a lesser extent, Hong Kong Disneyland Resort. The increase at Shanghai Disney Resort was due to the park being open for all of the current quarter compared to 3 days in the prior-year quarter as a result of COVID-19 related closures. Higher operating results at Hong Kong Disneyland Resort were due to guest spending growth and higher volumes, partially offset by increased costs driven by inflation. Guest spending growth was primarily due to an increase in average ticket prices. Higher volumes were attributable to increases in attendance and occupied room nights. Results at Hong Kong Disneyland Resort reflected the park being open for 72 days in the current quarter compared to 54 days in the prior-year quarter due to COVID-19 related closures.

The decrease in operating income at Disney’s domestic operations was due to lower results at our domestic parks and Disney Vacation Club, driven by lower unit sales, partially offset by an increase at Disney Cruise Line.

Lower operating income at Disney’s domestic parks and resorts was attributable to a decrease at Walt Disney World Resort, while results at Disneyland Resort were up modestly compared to the prior-year quarter. The decrease at Walt Disney World Resort was primarily due to higher costs and lower volumes. The increase in costs was attributable to inflation and accelerated depreciation related to the planned closure of Star Wars: Galactic Starcruiser. Lower volumes were due to decreases in occupied room nights and attendance. At Disneyland Resort, higher attendance and increased guest spending were largely offset by higher costs driven by inflation. Guest spending growth was primarily due to an increase in average ticket prices.

Growth at Disney Cruise Line was due to an increase in passenger cruise days, partially offset by higher costs associated with our ongoing fleet expansion and increased depreciation.

The decrease at Disney’s merchandise licensing business was due to lower revenue from merchandise based on Star Wars, Toy Story and Avengers.

There were no additional details regarding Disney Cruise Line in the press release. We will update this post if we hear anything during the earnings call and Q&A.

Iger pointed out that “our Cruise Line in particular showed strong revenue and operating-income growth in the third quarter. Current Q4 booked occupancy for our existing fleet of five ships is at 98%, and we will be expanding our fleet by adding two more ships in fiscal 2025 and another in fiscal 2026, nearly doubling our worldwide capacity.”

For more information and an overall report click over to the Q3-2023 Earnings Report and the Q3 FY23 Earnings Presentation.